But the war has caused an increase in oil prices, exacerbated inflation, prompted drastic sanctions on Russia, and sparked a flood of refugees into neighboring countries, the IMF said.

The report projects that the economies of Russia and Ukraine will experience steep contractions. Russia’s is expected to shrink 8.5 percent this year and Ukraine’s 35 percent, it said.

The 19 countries in the euro zone will grow but by just 2.8 percent in 2022, down sharply from the 3.9 percent forecast by the IMF in January and down from 5.3 percent growth last year.

U.S. economic growth is expected to drop to 3.7 percent this year from 5.7 percent in 2021.

The IMF expects the growth of the Chinese economy to decelerate to 4.4 percent this year from 8.1 percent in 2021. The latest lockdowns in China to control the spread of the coronavirus are likely to cause new bottlenecks in global supply chains, the IMF said.

src: click

35% hier (GDP loss 2022), 35% da (Inflation über 4 Jahre, bis 2027) - mit der Zeit kommt da richtig was zusammen…

Die NTV Moderatoren sind zeitgleich noch sehr verwirrt:

Hintergrund:

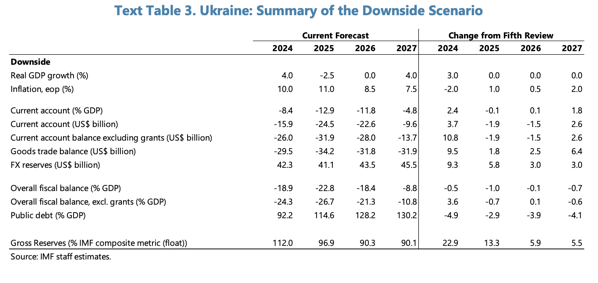

This [second, war until mid 2026] scenario estimates an external financing gap of $177.2 billion, compared to $148 billion under the baseline, with international reserves remaining below IMF criteria until 2027.

src: click

IMF Report: click

C. Risks to the Outlook

11. Risks to the program scenarios remain exceptionally high and pertain to the war, international support, and reform momentum. Overall, both the baseline and downside scenarios continue to be subject to exceptionally high uncertainty, including with regard to the trajectory of the war and its implications for the post-war recovery:

• The war could intensify or last longer, implying headwinds to economic performance and policy implementation and posing risks to the medium-term outlook. Further attacks on energy infrastructure compounded by a harsh winter, and adverse demographics constitute a specific risk on this front. As time goes on, scope is narrowing to recalibrate the program’s war assumptions and restore medium-term external viability by the end of the program.

• International support may no longer be durable. The program scenarios assume that Ukraine will continue to receive significant financial and security assistance into the future. Should the appetite of Ukraine’s partners to continue support begin to wane, either Ukraine would face pressures from abrupt shifts in policies or suboptimal responses to close elevated financing gaps, or the trajectory of the war itself could deteriorate. The materialization of either could entail substantial impacts including weaker economic performance, eroded policy buffers, a more fragile security situation, and social disruption.

• An earlier end to the war could entail a wide set of outcomes. A potential peace settlement could, on the one hand, result in an upside scenario conditional on the available international support and accelerated reforms, a stronger recovery and medium-term potential could result from a quicker return migration and private investment flows anchored by EU accession. On the other hand, despite an earlier end to the war, the security situation may not stabilize promptly thereafter, or the war’s ultimate damages could be even greater than currently understood. In this event, there are risks of adverse economic and social outcomes, including lower private investment, higher migration, and weaker reform momentum, entailing a slower or incomplete post-war recovery.

• The onset of reform fatigue is a vulnerability regardless of the evolution of the war. Delivering the program’s objectives will require steadfast implementation of policy adjustment and structural reforms over many years (including under the downside scenario), which may prove challenging, including for social cohesion.

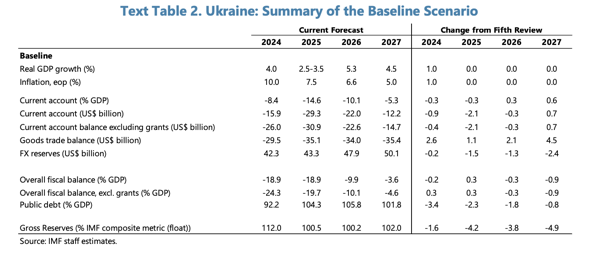

Das hier sind die beiden relevanten Tabellen:

GDP development:

2024: 4.0%

2025: 2.5-3.5%

2026: 5.3%

2027: 4.5

Gesamt: 16%

Inflation:

2024: 10.0%

2025: 7.5%

2026: 6.6%

2027: 5.0%

Gesamt 29.1%

Downside (war ends mid 2026 and things develop worse in general):

GDP development:

2024: 4.0%

2025: -2.5%

2026: 0%

2027: 4.0%

Gesamt: 5.5%

Inflation:

2024: 10.0%

2025: 11.0%

2026: 8.5%

2027: 7.5%

Gesamt: 37%

edit: Fifth review was released on: October 18, 2024

Sixth review was released on: December 20, 2024