(In terms of market cap volume.)

Solana rose by 31% in the past 7 days.

Höhö.

Solana surges 12% on launch of Trump-themed meme coin, ether falls [more than 6%]

Market Cap increase for Solana since Trump meme coin launch: 28.9 billion USD.

Market Cap decrease for Ether since Trump meme coin launch: 22 billion USD.

Trump meme Coin market cap: 14 billion USD.

So the 28.9 billion are bots/trading houses hoping for a softer landing after the scandal.

Of the 22 billion (unrelated) about 1/3 (?) are early investors that will jump before a rug pull.

Which means that up to half of the people currently invested in Trump meme coin might be new suckers.

Meaning 7 Million people with an average investment of 1000 USD each.

If half of the 22 billion are early investors that will jump before the rug pull -

that would mean that a fourth of the people currently invested in Trump meme coin might be new suckers.

Meaning 3.55 Million people with an average investment of 1000 USD each.

Lets assume 500.000 people invested 10.000 USD each, that would get you to 5 billion. Thats a bit too much.

So the ultra suckers are probably about 100.000 - 200.000 people. They will lose everything. (Sounds about right.) Then come the speculative suckers that didnt get out fast enough, when a rug pull happens. Then come the normal suckers. And then the low amount invested new suckers. In terms of how much they’ll hate Trump.

Lets look at this differently.

If you are China. Or a random entrepreneur.

All you need is about 7 billion USD invested - to get the Trump administration into their biggest public scandal yet - within 3 months of the US presidents inauguration. Guaranteed.

About 1 billion USD invested if you want to have a really good chance to trigger a mass exit event at the time everyone expects the Trump trust to pull the rug first. (3 months from now.)

5 billion were invested between 9:00 and 14:50 MEZ today.

TOTALLY WORTH IT. 🙂

Now, lets see on which day the first 5 billion leave within 12 hours.. 😉

Why? Well, the current market cap is remarkably stable.. 🙂

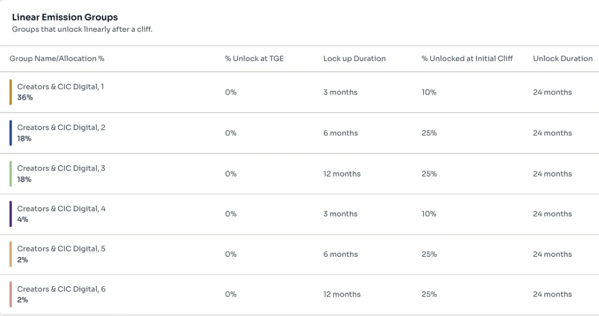

And Trump Trust dillutes the currency value by an instant 4% of total coins minted in exactly 3 months [currently worth 560 million USD], and up to 80% over 2 years.

So it will be fun to see if 5 billion USD plus leave within the first 12 hours Trump Trust gets its first 4%(to 10%, depending on how you read the allocation disclaimer. :)) of the crypto currency.

How can Trump guard against a third party triggered bank run? Promote the Coin at the inauguration.. 🙂 So that a withdrawal of 5 billion USD might be too little to trigger a catastrophic decline in value too early.. 😉 If the market cap stays at current figures, pulling 5 billion at once will certainly tank the currency. Likely even pulling one billion at the correct time, when everybody expects the rug pull to happen.

To be continued.

edit: Value is diluted by at least 1.6% point per month after the initial 4% for another 3 months of waiting. So 7.5% points after 2.9 additional months, then by an additional 5% points on additional month 3, so 12.5%, and then 6% points for three months thereafter, so 30.5% points after 5.9 additional months. Jumping to an insta dilution of another 5% points on 6, so 35.5%, then adding another 2% points of dilution per month ofter that, so at month

11.9 we are at 47.5% dilution.

Meaning, most likely jump up off points are - 5.9 months from now. Followed by - 8.9 months from now.

I’d be amazed if we reach the next most likely jump off point at 14.9 months from now. Where the currency is already almost 50% diluted.

If someone wanted to eff Trump over and managed to do so the best point to tank the currency would be 3 months from now, and then likely at 4 and 5 months from now. After that its all just Trump gained too much not to laugh off whatever happens next.

Jump off point month

3 for Trump trust is 560 million USD plus transaction fees (600+ million USD).

Jump off point month

5.9 for Trump trust is 1.05 billion USD plus transaction fees (1.05 billion USD).

Jump off point month

6 for Trump Trust is 1.74 billion USD plus transaction fees (1.75 billion USD).

At current market cap values.

Now lets say new suckers rate is 3.5 billion USD of the current 14 billion market cap. 80% of that (dilution factor at the end) is 2.8 billion USD. But surly they will move their money, at the 50% diluted in value mark, will they not? If half of them move their money at that point, and Trump sits it out, till the end, with no rug pull, its over 1.4 Billion banked at an 80% value dilution.

And all of that is finished after 2 years.

At that point, or probably earlier once (as in BIG IF 😉 ) value stabilizes after the first shocks, Trump will not move the money, but start to loan against this as an asset. So money gets pulled, when the loans fail or finish… (Which should be before his presidency ends.. 😉 But then, no more coins are gained by Trump trust after 24 months, so - that fits.. 😉 )

edit: Wait, whats that! First 5 billion USD drop in market cap happened merely hours after I wrote that, and the currency didnt tank. But recovered (not to initial values). But thats all before the first Trump Trust payout - that drop just means risk reduction for Trump Trust (and an early cash out). To hurt Trumps reputation that would have had to happen after the first cashout round. 🙂

Also to trigger a mass exit effect it would have to happen after the first Trump Trust cashout round (= 4% dilution of the currency), only then people/investors would be afraid of a rug pull, and only then political damage could be done. 🙂

Pulling 5 billion before that is unfair… 😉 As in, there is no fun to be had with this at all… 😉

As in 5 billion of 14billion market cap decided, Trump will not promote the coin at the inauguration, and so, the value will likely drop from 20th of january onwards, so lets get out… But then 3 more billion got in, and then more people moved their money out. 🙂 Thats not fair. 🙂 Political or reputation damage is only to be had after the first 3 months! 😉