So the most sane explanation of why the sudden Trump position reversal on tarifs took place, is because Canada started to slowly sell US 10 year yield bonds, while then also directly reinvesting the gains into canadian and european assets, and talking to the europeans to follow suit.

This spooked the Trump administration into immediate action, because apparently the mid term play was to hike up US treasury bond yields, relative to other secure 10 year assets, so the US would be able to refinance itself under more favorable conditions. Maybe - because none of this is supported by hard evidence.

But here is the kicker. It worked?

edit: It did not. Lower 10 year bond yield is better for refinancing. So Trumps plan backfired. Got it now.

edit2: Actually, yes but no - this gets crazier by the minute. Again, bond yields at the time of issuing should reflect long term interest rates. Bonds are issued monthly at then current rates - and the Fed doesnt have to refinance anything. Says some currency analyst at forexlive (click).

Which means, what I read from the “Bitpanda CEO” in exxpress past week was wrong. Shocker. But more problematicly - what a France 24 expert hinted at here also was off.

You gotta love it, when people are reading memes these days and then are cited by media that never factchecks them…

In short - bond yield rates are important - but “refinancing” at lower yields would have required sustained long periods (years), not months by reissuing them the normal way - and the FED is not required to buy US government debt to refinance at any rate/point in time. Because separation of power.

Great, if only someone could have told that to the Bitpanda CEO and France 24…

edit3: Next step: What the U.S. Treasuries sell-off means for Canada and Online posts claiming Canada ‘offloading’ $400 billion in U.S. bonds are false

German 10 year bond yields are down from April 2nd:

src: click

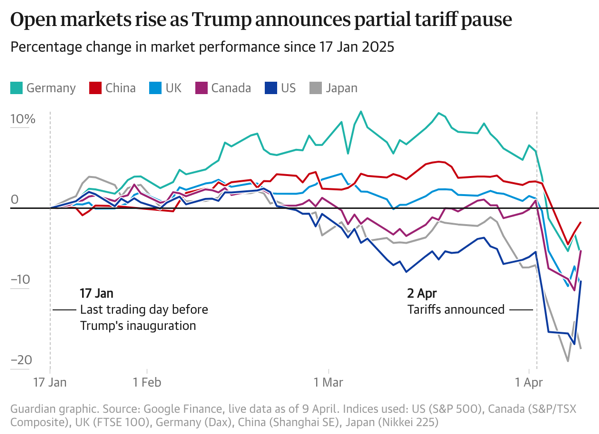

Stock indices in all major western markets are down comparatively to the starting point on April 2nd, and compared to the US current stock market index relative to that point:

src: click

After the market recovery (Trump announced 90 day “pause” for all but 10% baseline tariffs) the S&P 500 started to decline again, but then recovered again, so currently it only took a minor loss compared to the high of the recovery pictured above.

And most importantly - US 10 year treasury bond yields are up compared to April 2nd:

src: click

So what the flying fuck is european media reporting here? Granted the increase in US 10 year treasury yields wasnt huge at this point - but if you have to refinance $7 trillion of maturing debt in 2025, like the US does, you just saved 6.72% or 470.4 billion, if I’m not mistaken. (I was mistaken, see above.)

Ok the US and the rest of the world lost $6.5 trillion in stock market value at the same time (combined figure), but what does the Trump administration care? They mainly should care about volatility risk.

Of course the US probably didnt refinance much in the past days and everything still remains somewhat volatile, but what the fuck is the european and US press reporting currently?

Also related question, why the heck is the Euro rising in worth compared to the USD?

Are investors buying spanish stocks again?

Well no, not so much: click

So what the flying fuck…?

Ah - yes,

Meanwhile, the euro got a boost from positive developments in Europe. Germany’s proposed €500 billion infrastructure fund and coalition agreement reports signaled increased government spending, which can stimulate growth and inflation expectations. This likely reduced bets on aggressive European Central Bank (ECB) rate cuts, supporting the euro. Unlike the US, where Federal Reserve signals remain mixed, Europe’s outlook appeared less shaky to some traders, especially with hopes of stabilizing energy costs if geopolitical tensions (like Ukraine’s ceasefire talks) ease.

src: click

The german infrastructure investments might explain some of it - BUT 0.0151 USD per Euro worth of it? With all other indicators pointing at the value gap widening? (Stocks, 10 year treasury bond yields, …)

Gosh, I wish I had media that could explain this to me.